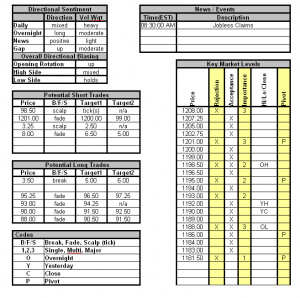

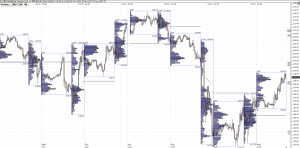

Obviously the good claims number was priced in hence no reaction with volume. You have to read between the lines in this market and don’t be too quick to jump to the long side today. The overall volume was actually mixed yesterday despite the so-called “good news” of the Fed language. The VIX has continued to climb as well and the Euro Yen cross price action is still a bit bearish signaling risk appetite has not fully returned despite heavy volume and OI. However, we do see significant program buying into the close. Putting it all together we feel caution is the best approach to directional plays and a few levels will be of great importance today. Overnight volume has been spread out across the range which means there is no “line in the sand”, but we feel 89 is solid support on the day and 1201 is interim resistance. It has been an important level for some time with rejection from both above and below and a pivot there as well. Should be the best short fade opportunity of the day. The OH has been moving all morning and as such we would advise watching flow carefully and only scalping it. If we do break above 1201 there should be a good scalp op at 3.25 and a another great fade op at 8.00. We see no goo short breakouts this morning. On the long side, we like all of the low volume pockets on the low side of the overnight range. 95.25, 93.00, & 90.00 all have good potential and the OL at 88.00 should be great too if we do test it, which I doubt. If we do break above 1201 we like buying 3.50 into 5.00 or 6.00 as that is a pretty clean set up. If I had to guess I think we test 1201 & if it holds we grind and fill in between 95 and 1200. If it fails I think we still stay under 8.00. Of course we will be done in the first hour so it really doesn’t matter much to us. As always, watch order flow carefully and today the volatility should come off a bit. If it doesn’t be very careful betting the long side.

Apr 292010

Sorry, the comment form is closed at this time.