Apr 252013

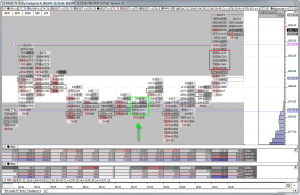

I posted in chat pre-market “if price can get close to the R2, the YH/R1 area could be a good long continuation area later” and “the 77/79 area is the critical area between bulls and bears. I’m expecting the OH to be retested at some point before the 77/79 area has a chance to be pierced.” That’s exactly how the ES played out this morning. The key directional wildcard was the Jobless Claims report at 8:30am EDT. The numbers beat expectations, but by that time price had already climbed to the R2 area and the number didn’t encourage the bulls to take price higher. The ES pulled back into the wide DTG 79 level and unfolded into a long order flow opportunity.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.