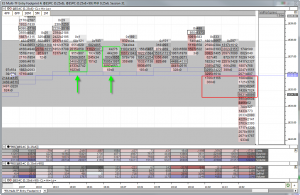

No economic reports today to give the markets some direction, but I was hopeful that the Draghi testimony before the Committee on Economic and Monetary Affairs of the European Parliament would provide something for the markets to focus on. After a 12 point move during the Asian and European sessions, not much happened in the ES today. Coming into the morning session, I was thinking the gap started by the FOMC announcement and Bernanke’s press conference back to 1649 would be filled today. The overnight high was 1638 and my basic plan was to be long above it; preferably entering on a pullback. The ES showed some promise early, pushing up through the DTG 34 level to touch the DTG 39.50, however it gave little indication that a top was in place. The ES pulled back towards the VWAP and R1 in the DTG 34 level and unfolded into a couple of long entry opportunities. The ES then proceeded to stay in a narrow range for nearly two hours. I was hopeful that the range would resolve itself to the upside, but price finally worked through the VWAP and R1 and slowly grinded down, creating losses for for the long opportunities. In the annotated chart below, I make some trade management suggestions for these opportunities to minimize the loss.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.