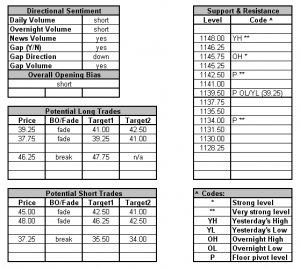

Initial claims was at the low end of consensus and trade is really a mixed number because even though US trade deficit shrunk of course it signals worldwide sluggish growth. The overnight low and yesterday’s low at 39.50/25 may see a break today so the fade trade at those levels is a little dangerous for more than a scalp. We will only trade it back to around 41 or so if it comes up. We also believe the overnight low of 37.75 from the overnight Tuesday could be interim support as well ahead of the weekend and may be tough to get through as well. In our view the highest probability short break out gets an entry at 37.25 or so and trades down into the “fulcrum point” at the 34 handle. That will be the level that determines whether this market stays up or drops like a rock back to the 18 handle. If the market moves up for a retest watch for failure at 45 as there is a deep notch of unfair value there and at the same relative level in the NQ as well. Based on order flow there could be a fade there or at the overnight high of 45.75. If it breaks above there we would wait and get long if order flow is strong at 46.25 or so and trade into the final retest of the 48 high. We doubt very much we get there, but if so of course that is a great fade if you do it as a sort of final price action failure trade. If you wait for the nuts on that one (as we say in poker), that is a nice big trade all the way back to the ever important 42 handle which we think is really the dividing line between buying and selling interest today.

Mar 112010

Sorry, the comment form is closed at this time.