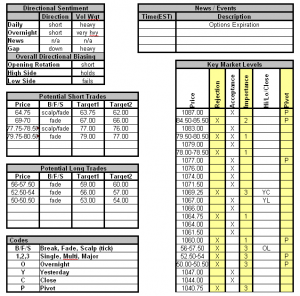

We got a little pop off the lows this morning on the new resolution release news out of Germany but the real question is whether it ever mattered at all to the health of the market in the grand scheme of things or is it just the excuse for a reality we have faced for months and months now and an artificially inflated market unsupported by money flow. I got some news from the Spoos pit this morning that Merrill, Goldman, JP, et al, who up until today have been buying the lows have been selling them all morning. That doesn’t bode well for an impending bounce. We will see. We are moving into lows last traded in February and there are a few very critical lines in the sand. I suppose we would like to put interim support at the 53 handle, but then 50 is right there too. If we break 50, we go straight down ten handles to 40. Once again, overnight volume is very heavy with big lot trader deltas dominating the short side. The bid in the 10s continues while the Euro edges up but flatly and the carry trade is locked in uncertainty. We are no doubt at the edge of the cliff. The one other thing that concerns me is that with expiration today we may see traders flatten and play a wait and see game on equities on the uncertainty. That would mean we have no buying into the weekend further removing support. Plus, the option traders have been crowded into the short-vol trade and were wrong so we are seeing reactionary trading to cover those trades as well which only serve to increase volatility. All this said I really have to say we grind down a bit more and test some more key lows. We will look to fade them though as with the high expected volatility we should see good rotational activity at all levels today. We will only scalp the OL at this point as I doubt it holds and will possibly fade either the 53-54 or the 50-51 handles depending on how the flow looks. If we do flush all the way down, we love the 40-41 fade trade and we do expect institutional buying there even if they pass on the 50s. On the other side there are several nice short fade ops on the long levels and they are well defined. We will likely just scalp the 65 handle and look for good full rotational fades at 69-70 and then again between 79-81- if we get there which I doubt. Even if we get a pop on news given the OE and the day of the week and the uncertainty I think 69-70 holds firm and even on good news we would grind in around the mid to high 60s to finish the day. Expect high volatility today as the short vol trades cover which will make it easy to get run over with stops too tight.If it gets really wacky you may want to consider sitting out. Discipline is key and you will notice, we have not had many trades this week at all. In wild, trending conditions we shouldn’t. After all, we are contrarian traders who benefit most from normal, grinding mid volume, mid volatility conditions.

May 212010

Sorry, the comment form is closed at this time.