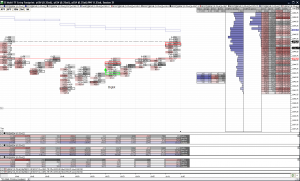

Today is a great lesson for the impatient or those who think analyzing and adapting reactions to developing market structure is not that important. We sold off to close the gap and that was the first impatient trader trap. You had to notice that the YL was so close the market would very likely want to test that as well so you didn’t get sucked into the first “head fake” turn. Then you had to notice that institutions were leading the selling in a strong downtrend at that point and as such it was pretty much automatic that we would see a test of the OL. At that point you had to use market structure and see that there were two strong previous acceptance areas at 44 and 43 just under the OL that would draw price to them. From there it was pretty easy as we probed down into the obvious rejection area around the 42 handle then got a rotation up followed by another rotation part way down that failed. Institutional buying came in on that rotation down and that was the spot. Depending on how you like to manage your trades the first part of the trade was worth about a handle and then you could have rode it much further as well. As you know we have several trade management schemes and we get non-correlative benefit by running many and blending the results all together.

I’m sure there were some that had a tough time today getting stopped out by jumping the gun. Hopefully lots of you are heeding our advice and trading a single op each day. If so and you jumped the gun you only had the one loss today and learned from your mistakes. I’ll be interested to hear if any of you waited it out until the key test at the bottom and took only the highest probability opportunity today. Hopefully all of you. Then again, even if you traded them all if you were scalping them you could have made money from most all of them – surely net in the black at least. Remember, success in this game isn’t about setups it is about making sure you trade when you have the highest probability for winning. As a common sense rule of thumb, if you EVER have any other levels that are just above or below where you are at you should always be wondering why it wouldn’t be tested for supply – especially if the market is trending and sucking up all the supply quickly at the other levels. By waiting until there is nothing important over or under you there is no doubt you are making the right choice by following order flow. You still might lose, but it will be because you were wrong and not because you were impatient. I realize for many of you right now it is hard to understand what the difference is. The answer is you just have to learn the structure and behavior stuff by watching and doing and it takes a long time. I have been watching this market like a wacko for 20 years and a certain amount of my success comes from me just “sensing” when the market is or isn’t done probing and combining that with all the macro stuff, order flow, big trader knowledge, pit intel, etc. It all adds up…

Sorry, the comment form is closed at this time.