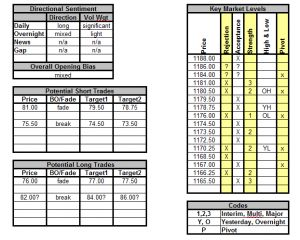

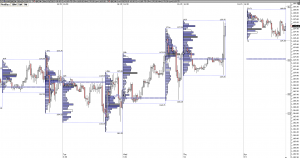

Volume has been very light throughout the night and morning with the market poised to make its move. There are some fantastic rejection/acceptance areas to play on potentially today. As we have been expecting for a week, 81 is the absolute last rejection price as past there we get into what we call “zero prints”, which means the market essentially skipped over in September of 08. Be VERY careful fading another move to the OH/81 as if it gets it head up, we expect prices to lift offers HARD up into 84, 86, or even 88. The Pending Home Sales number may be pivotal today. With the huge decline last month and an expected improvement to just a 1% decline this month it may be the last bit of good news following the excellent jobs number to start the climb to 1200. If we do breakdown at all watch the fade at 76 long and maybe just scalp it. If we auction anywhere under it even with a probe there may be an awesome short breakout trade at 75.50 or so through the long low volume rally from last session, targeting 74.50 or even 73.50 which we believe is interim support right now on the day. The bottom line is we may see a significant break today above 82 or below 76 given the strong previous rejection patterned volume for each. Institutional volume overnight and this morning favors the long side.

Apr 052010

Sorry, the comment form is closed at this time.