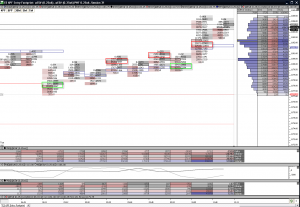

We said pre-market that we didn’t think there would be much traction outside the range this morning and that really showed up in the price action and order flow. We didn’t find anything we liked that had appropriate risk/reward for trading to key levels so I just scalped for ticks all morning. These conditions are wonderful for that. Scalping is an entirely different skill set and beyond the scope of this blog, but if you can ever find the time to get some scalping chops you will find it is always there as a fun and high probability way to extract money from the market. In the chart below I have identified the spots I scalped in. Just buying bids and selling offers. Longs in green, shorts in red. It is all about feel really and very tough to teach in my opinion. It is like telling someone who doesn’t play golf what it feels like to hit a ball in the sweet spot where you can feel it resonate like a musical note through your body. If they haven’t felt it, they would have no idea what you are talking about. Scalping is a bit like that…

UPDATE: Finally got a failure play today just ahead of the close. The first push up into the 84 handle around noon didn’t get any exhaustion with it, nor did the first push into the 86’s/7s. But on the second test of teh high it set up the way I wanted and I sold 86 into just ahead of the thin 84.50 price at 84.75. Long wait for another 5 ticks to add to the scalp, but that was a free trade for sure in my view and I happened to be at the desk.

Sorry, the comment form is closed at this time.