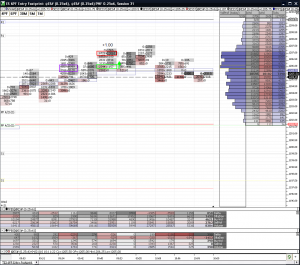

I wasn’t expecting quite the stall we saw at 5.75/6.00 this morning. I started with tick scalping it and then waited for a good spot to get long. I didn’t trade the first push up, though NJ did and stopped out for a 6 tick loss. I grabbed the second push with intent of trading ito 7.75 or so, but when it stalled I got spooked and came out with a point at 7.00. I have stuff to do so I am done for the day with 5 ticks profit. NJ is in another trade so we will see how that goes but we will may finish net loser today for the first time in a while across all accounts. I know you are all surprised and thought by now that we never lose. LOL!!! Oh my God, the DTG boys are human. Ahhhhhhhh!!!

NJ Update 11:50am EST: I let the same trade (long 1206.5) sting me twice. I had ample opportunity to take a tick or two profit on the second trade but I got blinded by my upside bias and let the trade slip away into another 6 tick loss. The market did provide a couple of additional long fade opportunities off of the 1202 and 1198.75 price levels as it moved down. I took 4 ticks on each to bring my net for day up to -4 ticks.

2 Responses to “4/21/2010 Post Trading Analysis”

Sorry, the comment form is closed at this time.

I had 5.75 as a level to fade. My execution was not great, my fault, and entered at 5.50. On the spike to 6.50 I got out for a 4 tick loss.

I bought your contracts at 6.50 and we both lost. 🙂 The 5.75 fade happened right after the open when price touched 5.50, then moved down to 3.75. RG scalped it, I missed the trade entirely. Good job at keeping your risk low.