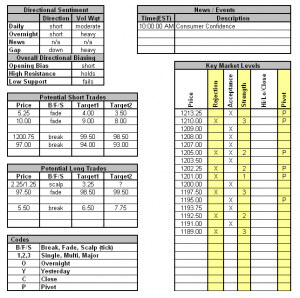

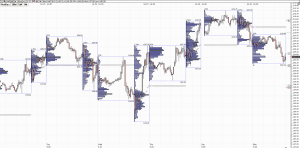

No news until consumer confidence until 10. Despite continued signs of economic improvement led by CAT earnings and positive statements, continued global debt woes and technical pressures pull us to the short side. Overnight volume is heavy once again with institutions more than 35% favored to the short side. Despite this pressure though, all eyes are on the OL this morning. My gut says it doesn’t hold so if we are still there or we rotate up and then return to it, I doubt I will fade it – even for a scalp. Probabilities are weak for it holding. Don’t be too quick to chase a break of 2.25 though as it has to get through the critical 1.25 handle which may be tough as well. I will be watching order flow carefully there and may at least get a scalp. If it fails I will most likely sell under 1200.75 into 99.50 and possibly on to 98.50. Beyond that I feel 97.50 should hold at least for a rotation and is interim support right now. If that breaks, the next key support level is around the 92 handle. If we do rotate up on positive news, the first potential trade is the 5.00 handle fade, though WATCH out there as we may break through hard. Beyond that the gap fill trade is long from 5.50 into the YC at 7.50, though if it stalls be prepared to hop out early. I’m relatively certain that the OH will hold for at least a small rotation as that is probably our interim resistance level this morning given the multi-session lack of volume traded there. Direction is tough to call today within the extreme ranges so watch the flow very carefully.

Apr 272010

Sorry, the comment form is closed at this time.