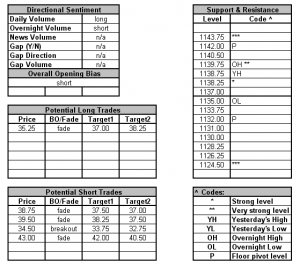

No gap, no news, market in balance overnight. Of note is that despite the rally the volume is tepid. Everyone is already long. Mutual funds report the lowest cash positions since 07 just before the big sell-off started that continued into 08′. This is a topped out market in our opinion – at least in the short run. We aren’t crazy about any breakout above the overnight high as it is breaking into strong resistance around the 40 handle. If it breaks long, we would rather wait for a potential fade at the 43 handle depending on order flow. The only other long trade we are looking at is a fade of the overnight low from 35 trading back into balance at 37 or so. On the short side there are several trades which bear looking at. A fade of the first test of either Friday’s high (38.75) or the overnight high (39.75) may bear fruit but it is hard to say which will pay off. WATCH ORDER FLOW carefully on these as you could get run over. Either is a feel trade back into balance between 38 and 37. If we break short we would wait for 34.50ish so as not to get trapped in the volatility of traders fading the overnight low. From there targets at the 33 or 32 handle range should be the ticket.

Mar 082010

Sorry, the comment form is closed at this time.