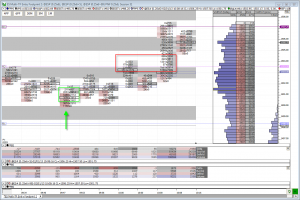

There was a plethora of economic numbers to digest this morning on top of pre-market earnings from Exxon-Mobile which turned into a catalyst for taking the DOW above 14000. All eyes were on the 8:30am EST employment numbers which for the most part were positive. After an overnight of good Swiss and Spanish economic data, the bulls were in a good mood. The ES was flirting with 1500 most of the morning which has been a major area of resistance for some time now. The employment numbers sent the ES straight through 1500 turning 1500 from former resistance into potential support. The ES came back down and bounced right off 1500 despite all the strong selling. Those sellers were potentially trapped and created today’s example trade opportunity. Today’s example trade is a little different than most because it’s heavily based on market context and belief in the strength of market structure (i.e. 1500 holding) more than order flow (which given the high volume today was not giving clear indications of buyer or sellers in control). Although there were potential trapped sellers, the entry was really what we call a semi-blind entry. Given the pending news, the trade opportunity was a coin flip trade (i.e. 50/50 chance of going either way), but as I try to explain on the annotated chart below, I thought the odds favored a move up.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.