After Friday’s big selloff into the close, it was expected to be volatile this morning. The ES average daily range had expanded significantly over the last week. The 5 day average is now 24 points where it’s been running around 17 or so points for much of the year. The program trading algos are out in full force creating whippy price movement.

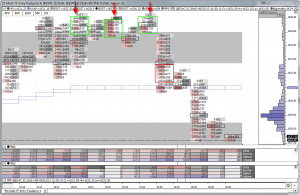

In addition to Friday’s technical sell off, there was plenty of economic reports to give traders more reasons to move the markets. The ISM Manufacturing PMI and Construction Spending both at 10am EDT created the first low of the day. Volatility was high before and right after the news making order flow entries unreliable. A long could have certainly be taken, but the reports all came in negative and any trade would be coin flip. Shortly after the 10am EDT reports, the ES shot up over 10 points into the back of the DTG 35 level. Several order flow opportunities unfolded as the level became an algo battle ground. These opportunities are today’s example trade.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.