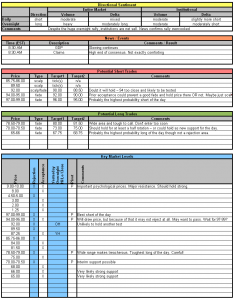

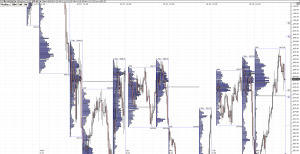

The fragility of the market and the contribution of volatility remains evident. We get this huge, typically overblown reaction to the China support of its investment in the Euro. I mean what else were they gonna say? Then again, if you look at history when it relates to sovereign debt problems, none have ever toppled the world or become a global problem. This morning’s US economic news confirms the more tangible items on the home front. GDP slows significantly with a continuation of its trend and claims, while at the high end of consensus are being priced in as significantly disappointing. The trading overnight also confirms that the China news rally was overcooked to a significant degree. Despite heavy broad market volume firmly to the long side, institutional orders were not participating and in fact have been and continue to be net short to a large degree – about 15% over the centerline or so. Of course we are getting the initial reaction to these items pre-market and we have to see where we base in. We said yesterday that we couldn’t honestly call support anywhere but the 50 handle, although I’m not saying that is really fair either. There are just so many levels that have been skipped over in the trading we will never know until we grind some volume through them. So that sentiment has not changed. We do think that we should hold 57 or so and possibly as high as 65-66 if we do have a sell-off. On the long side, we have the same basic pattern as yesterday. We don’t think the overnight high will hold as it will likely want to stretch out to at least 94-95 if we decide to rally. We are on the fence about that level though as it is right in the middle of a large acceptance area the day before. Still, we are fairly certain that either that or the 99ish level is the best short of the day. But with all these selling and buying tails from the silly volatility, the ranges are going to be very wide again and at most key levels there is a 2 point range or so that just has to be waited out. For fade traders this means risk of missing the trade but you have to err on the high side for shorts and the low side for longs or the probability is too high of being run over…

May 272010

Sorry, the comment form is closed at this time.