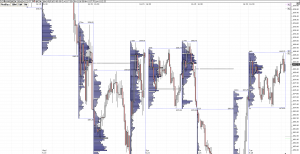

Durable goods came in strong with the highest number since 9/08. New home sales might see a sharp decline though from frontrunning March contracts. Remember, the number is based on contracts not closings so everyone wanted to go to contract in March so they could close in April for tax purposes. This may impact April pretty hard. All eyes still on the Euro which is mostly flat overnight but the real star of the morning is the strong offer in the 10s. The carry trade is also looking stronger with evidence of risk appetite returning rather strongly. Something to consider about this overnight rally though is that institutional volume was basically nothing overnight relative to the broad market. Moreover they are net short on the session, not long which continues to grow. In other words, we think the rally is a bit overcooked and we may see a significant retracement before continuing higher. We may see a full gap fill in fact depending on the timing and the homes and oil numbers. It will be interesting to see what the inventory looks like given the current price action. The long crude trade on hundred dollar year end price speculation is gaining momentum this morning. We think the mid 70s has a good chance of becoming interim support but we need the test of YC first. Otherwise support is too tough to call other than to call it around 50 or so which I think is way oversold. Still, the OL is fragile and I doubt we would fade another test of it. The volume right under it is too weak. Same deal with the OH which has been tested too much and I think will fail the next retest. We think we have fairly strong resistance in the mid 90s and if we do happen to get through, a ton of uncertainty from there all the way to 1100.

May 262010

Sorry, the comment form is closed at this time.