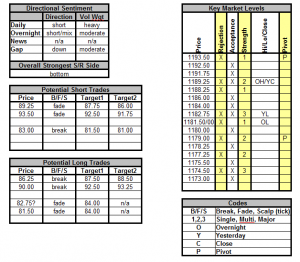

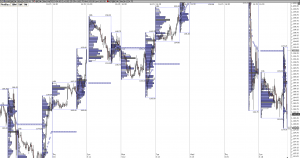

Rushing this morning so I’ll keep it brief. Despite the negative GS news the market is holding and strong Citigroup earnings will certainly help the cause. Despite significant overnight volume, the orders are mixed with the institutions losing interest in the short side. For these reasons we are slightly favored to the long side, at least for a retest of the important 89 handle. There are some spots to carefully consider and be careful of though regardless of which way we break. On the low side, don’t be overly romanced by fading the OL at 81.50 as it is just an artificial probe of single prints and may fake you out. The really key level is 83 and if it breaks there it may blow right through the OL and into the next important notch of low volume which we feel is the point of no return on the down side – 81.00. If we break that we may auction down steadily to the 75 or even 73 handles. So be careful fading moves to the short side. On the long side we like buying the open on good momentum above 86 into just ahead of the OH retest around 89. If we do break that level we might get long again into 93.75 which we feel may be some interim resistance and also a good fading opportunity. All in all, be careful on the fades today as we may see a quick gap fill up or a sharper move down if we get some more bad news.

Apr 192010

Sorry, the comment form is closed at this time.