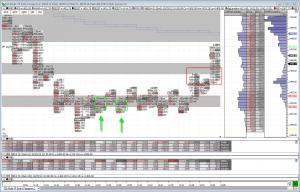

The ES has been in a pattern over the last few days: European sessions sends the stock markets up, then the US session sends the market down. Today continued the pattern. Pending home sales released at 10am EST missed expectations and the ES started to move down. Then there was a rumor floating around that Fitch was going to downgrade the US soon (that rumor was debunked; Fitch will keep they’re schedule and review the US again in early 2013). Order flow and price action did not setup for any long trade opportunities until the ES reached the DTG 01.75 level where it bounced before testing the S1 pivot below. Institutional buyers came out in force, tipping their hat that a bottom might be in and it was time to look for a long entry opportunity.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.