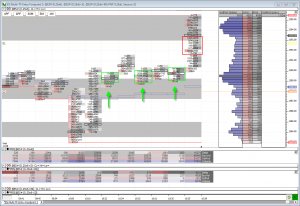

An active morning as reports and fiscal cliff comments increased volatility. The ES opened by dropping into the DT 87.25 level. The level was a strong level which tried to hold price into the 10am EST Housing Starts report. The first order flow trade opportunity was before the Housing report. Unfortunately, the Housing numbers did not meet expectations and price broke down creating a loss for any long trades from the DTG 87.25 level.

The news driven ES stopped at the DTG 83.50 level which tried to hold price. Suddenly price started moving up quickly as rumors about the fiscal cliff began to circulate. The sudden move away from the DTG 83.50 level did not provide any opportunities for order flow entries based on a 6PF chart. The 4PF chart however showed a nice entry opportunity before the rumors.

As the fiscal cliff rumors became known, trader expectations made a shift to bullish. The ES moved up through the DTG 87.25 level and then pulled back into the level for today’s example trade opportunity.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.