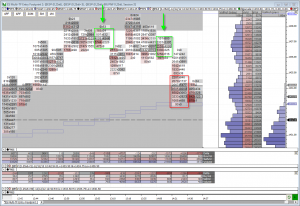

It was a Fed day the the markets quickly settled into Fed wait mode. The ES stayed in a 4.5 pt range until the 12:30pm EST Fed announcement. The Fed announced they would embark on an additional $45B per month Treasury purchasing campaign to offset the retiring Operation Twist of selling short term Treasury securities to purchase long term Treasury securities. The Fed is running out of short term securities, so they now have to resort to creating more money. I expected a big reaction to this news. The stock markets did move up, but it seemed muted. The ES bounced off the R1 pivot. This was a clue to me that an aggressive short trade might be possible. After the price rejection at the R1 pivot, the ES tried again to reach the pivot and failed. This setup today’s short trade opportunity.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.