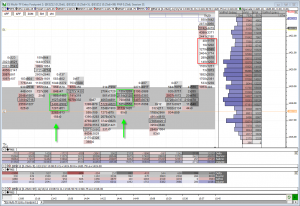

The US economic reports were mixed pre-market giving the stock markets no reason for a direction coming into the open. The biz inventories report at 10am EST met expectations and also provided no incentive for the markets to move. The only hope we had to get things going was for someone in DC to make a comment about the fiscal cliff. Given the low volatility, I wanted to fade either the Globex high or Globex low depending on which was reached first. The Globex high was reached, however order flow did not cooperate and I didn’t find an entry opportunity. The ES worked it’s way to the Globex low about the time Boehner was to give a press conference on the fiscal cliff. He didn’t really say anything that most did not already know and the ES rotated around the DTG 13.25 level for nearly an hour. I took a shot at a long in the level which eventually turned into a loser as price dropped into the DTG 16.50 level. This level provided several long order flow entry opportunities which are highlighted in today’s example trade.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.