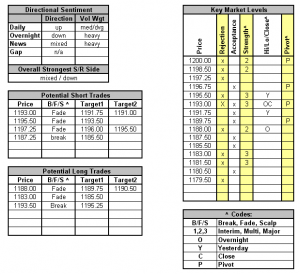

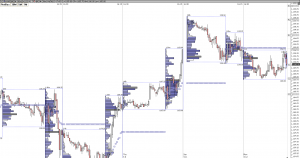

Sorry for the late post. We are having problems with a few of our data feeds this morning which has disrupted our analysis time. The retail and inventory news this morning was mixed resulting in the market moving back towards Monday’s close. There’s good room between acceptance and rejection volume areas today which should provide several trading opportunities. The daily bias is still up however the volume divergence is still in play and the market is showing signs of a temporary top with yesterday’s doji candle. The market is also opening below it’s floor pivot point indicating a down side bias. The 93 handle is fairly strong and should hold for a short fade opportunity. If not, the 95.50 level is the next strong level. For long trades, wait to fade the 88 area back into the overnight volume cluster.

Apr 132010

Sorry, the comment form is closed at this time.