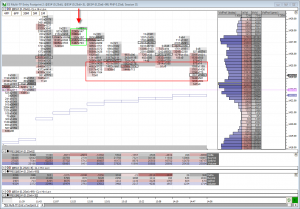

Today was a day that proved my expectations wrong. Given the uncertainty over the potential US presidential election outcome, my expectations were that the US stock markets would wait out today in a relatively small range before committing to a direction tomorrow. For the first couple of hours, the scenario played out as anticipated. NYSE floor traders had adjusted their positions to wait out the election results. And then; BAM! The markets made a strong technical break out to the upside; the ES rising about 10 points in 30 minutes. I scrambled to find out why and no good explanation existed. Once the ES reached the DTG 25 level, the institutional buyers took notice and started piling into the up trend which sent the ES 3 points past the DTG 25 level. A great looking short order flow opportunity occurred after the top in what I call no man’s land. This would be for aggressive traders only, since price would need to break back through the DTG 25 level to move far enough for decent sized targets. I had not planned on taking a trade today because the expected election induced low volatility and the reason for the upside breakout was not known, so I personally passed on this opportunity; but I was surely tempted… The DTG 25 level was the only level reached and I do not see any other trade opportunities from that level.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.