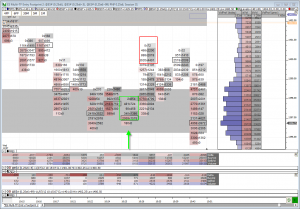

A very tough day for us counter-trend traders; it reminded me a lot of the wild days in 2008. The ES was already over 20 points off it’s Globex high coming into the cash open and dropped another 10 points in the first 7 minutes to test the 3rd DTG level of the morning. The first long opportunity came between 9:43am and 9:46am EST on the shallow pullback after the test of the DTG 02 level and the S2 pivot. Depending on the entry price and size of target, the opportunity either worked or it didn’t. The ES was not done with it’s downtrend. The next long opportunity setup after another 10 point drop into the DTG 96.50 level once price failed to make a new low and the buyers started stepping in. Like the first opportunity, the success of this one depended on the entry price and size of targets. The down trend was still strong and the ES would drop another 12 points before finding a blowoff bottom. The 2nd long trade opportunity is today’s example trade.

| Below is member only content. Not a member? Subscribe and join the discussion!. Click here to become a member |

Sorry, the comment form is closed at this time.